There are many ways to produce a strong Return On Investment (ROI) model, however I’ve always asked myself how much information is too much information? It really depends on your audience. I’ve produced multiple versions of the same document for different groups some being more detailed and others just the revenue results.

I’ve been known to go extremely deep into a program if I have the time for multiple reasons. One is if I’m trying to prove a point or I feel if the program could be used in the future and we need to remember the good and the bad.

This article will walk you through all of the components I include in my models, however for each program I may add or remove items. Remember, an ROI can either make you look like a hero or someone who hasn’t a clue what they are doing. But the one thing you must always remember is that you learn each time you produce a campaign. If something doesn’t work, note it, and discuss it. Learn from your failures and don’t repeat them. Documenting and understanding why goes a lot further then trying to manipulate the data in your favor.

I’m always leery of vendors who create their own models. Because additional income can be a major motivator and sometimes their methodologies always seem to work to their advantage. How many third party vendors have you hired have come back and should you statistics that their project resulted in a negative ROI. I’ve received positive results from groups, however when you review their components they leave out or twist the data to their advantage. It may make you look great, but when finance looks at it and flaws are exposed marketing becomes the unbelieved group. If you do have ROI's produced by vendors, have them walk you through their methodologies. If you agree then use them.

Web analytics are a different story to themselves and I will work on a new blog specific to the subject, however for now conversions from a web page may just be a lead. Now whether that lead has any quality or closes is a different story. Just remember if a vendor is looking for conversion through a funnel they may be able to product results but those results most of the time do not produce revenue.

How to Start

So how does one start? I've always felt it was important prior to any campaign to sit down as a part of the development process to determine how the program would be tracked and what the criteria would be used to evaluate the program. It is best to have someone from finance and IT in the meeting so that everyone walks out of the process on the same page. It will be a give and take meeting. Everyone has to be comfortable with the program and the expected results.

Review your MCIF system, some provide Pre ROI models allowing you to run multiple scenarios and review break-even results prior to spending any money. It's best to know ahead of time if you can produce any type of results prior to spending any money.

If you have not done so, start working on a strategic alliance with the finance group. They can be your biggest ally in the process. Don’t just take it upon yourself to devise programs because you think it is the correct thing to do. Finance will have the knowledge as to the needs of the company whether it is additional loans, or maturing CD’s or even to do nothing.

Strategies are built from needs of the institution not on the flavor of the month.

Marketing will still have total control of the project execution but it is extremely important to have the buy in up front so that everyone can agree on the results good or bad in the end.

Documentation

Every campaign should have documentation that can be filed away as to the what the program is about, the dates ran, media used, along with costs, what will be tracked and how it is to be tracked. What are all of the initiatives that the program is looking to achieve?Are there any incentives to either the staff or new customers.

This will be your overview and the first component of your document. You may feel it is just filling the page, however I’ve always found the information to be invaluable for the future.

1. Overview-Campaign Description, Run Dates, Media Used, include flights and costs.

2. ROI Methodology- I’ll provide a separate heading describing what the

program will be tracking, how and why.

3. Run Rate

One additional component should be a heading to itself that most marketers and vendors leave out is what I call a “Run Rate.” This rate is if you looked at the number of accounts acquired in a prior time period, preferably during the same month a year ago, that were opened during a non-promotional period. This becomes the baseline.

For example at any given period of time your organization will be selling product. These accounts are ones produced as a result of no promotion. So your company can do nothing and you can produce results. This is considered a Run Rate.

The philosophy is anything above and beyond this normal Run Rate will be considered the lift the campaign contributed. Always look at number of account and total deposits or balances. These two numbers when trended can help determine if you are adding more accounts at less balances or less accounts at higher balances

This component alone should bring the rest of the company on board to agree that the results you will be providing will be legitimate.

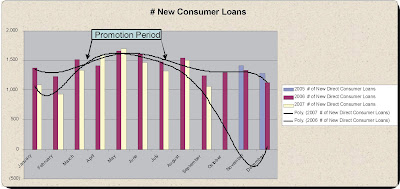

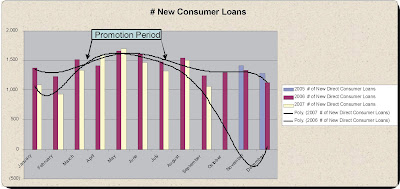

I like to provide this information both in numeric and graph form.

|

| This example is a trended run rate of new consumer loans for a number of years. Trended data can show issues in the economy or your sales process. Use the average "Run Rate" as your base line. |

The more data that you can provide the better. I work to provide as much information as possible to the reader and myself for the future.

4. Revenue Calculation

The next component is your revenue calculation. Again you will need to work with your finance or treasury group so you can agree on the calculations.

Here are a few to discuss.

Revenue Calculation: Direct Consumer Loans

½ of face value of loan X Month Spread / 12 X the average life “with assumed pre-payment” Original Balance. Example: $50,000/2 X 3.25% / 12 months X 21 months= Life Time Value.

$25,000 X .271% X 21 months = Monthly Revenue

$67.75 X 21 months = $1,423 Life-Time Value.

Revenue Calculation: Equity Line of Credit

45% of face/2 X Month Spread /12 X the average life “with assumed pre-payment” Original Balance: $50,000X45%/2 X 3.25% /12 months X 72 months= Life Time Value.

$11,250 X .271% X 72 months = Monthly Revenue

$30.49 X 72 months = $2,195 Life-Time Value.

Note the ½ value of the lines in this example. Since it is difficult to determine the actual amount that will be used, some clients will take the entire amount and others could take months or years to use their lines. It was agreed that ½ the face value of the loan would be fair for the revenue calculation. For loans other than lines the actual balance would be used in the revenue calculation

Average Terms:

Direct Consumer Loan pay down based on 12 months of data is 58%, for an average loan life time of 21 months.

Home Equity Loan Pay down based on the same 12 months of data is 16%, for an average loan life time of 72 months.

Note: An important part of any ROI is the understand pay down or early withdrawal. Working with your finance group this amount can be used to refine your final calculations.

Accounts without Spreads:

Any client that does not have a spread associated to the loan because of no drawl or payout, the following spreads will be used.

Direct Consumer 2.5%

Equity Line of Credit 2.25%

Credit Cost:

Credit Costs will be added to provide provisions for loan loss. This percent will be multiplied by the correct portion of the face value. Equity is multiplied by ½ the Equity Lines of Credit Usage and ½ the face value of a Consumer Loan.

This amount will be calculated for each response to determine the revenue per account. The accumulation of these will be the programs life-time revenue.

You can basically do the same for deposit products determining average life of the product, spread, etc. If your average life-time is 6 years on deposit products opt for a lesser number such as 2 or 3 years. Although your results for your ROI will decline this effort will go along way in your organization acceptance to the results. Don’t leave out in the documentation the average life of the product. It will allow the reader to understand how conservative your revenue calculations are.

Document Prior to Campaign

If you have the time prepare all of your documentation prior to the campaign. It will help in the long run and speed the process. Your first document may take some time, however after you have all of the components down then for each new program you will only need to make minor changes.

Data Collection

After the campaign has run, I collect the data. Depending on the promotion I always seem to have some stragglers so at the onset we determine the cut off date for the promotion. I normally wait for a month after the campaign, however it may depend on when you update your MCIF and the competition of the campaign.

Follow the guidelines you set down to extract the data. Only the direct results are ones that I use for revenue. Indirect results those accounts that could have been a result of the campaign can be shown, however, I never use them in the revenue calculation. Make sure you note these.

There are multiple ways to grab this data, however two that I like to use are new households during the campaign that purchased the product, grab the household information and distribute by product or service. Take a snapshot and include in your documentation.

Note: This information could really be used in your ROI as revenue, however I’ve had better success in under-estimating the results allowing the reader to make the conclusion it could have been added.

The second part would be all existing households that took the product and opened additional products during the promotional period.

Note: Although the promotion could have been the determining factor for the product opening, the result of good salesmanship I have only included this data as information. Document the results the same as those for new households, however never use the data for revenue.

Results:

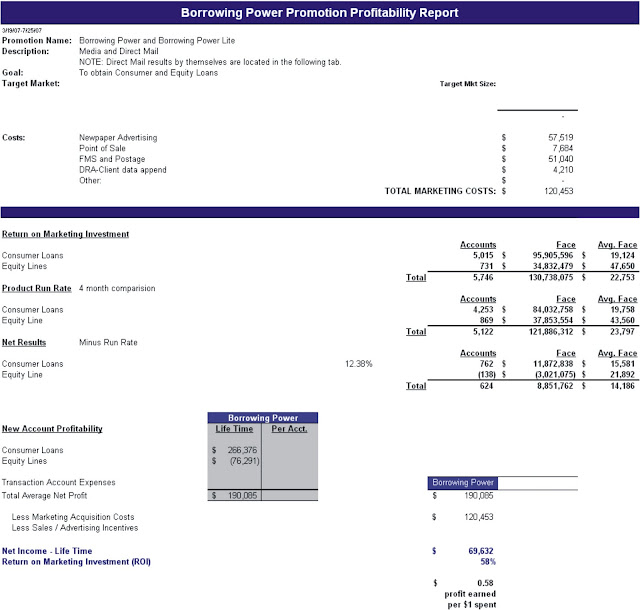

I produce a single Excel sheet that has my revenue and calculations embedded. This saves time so I can save a standard copy to use again. Once I have completed entering the campaign results I copy and insert the results document into my final word document.

|

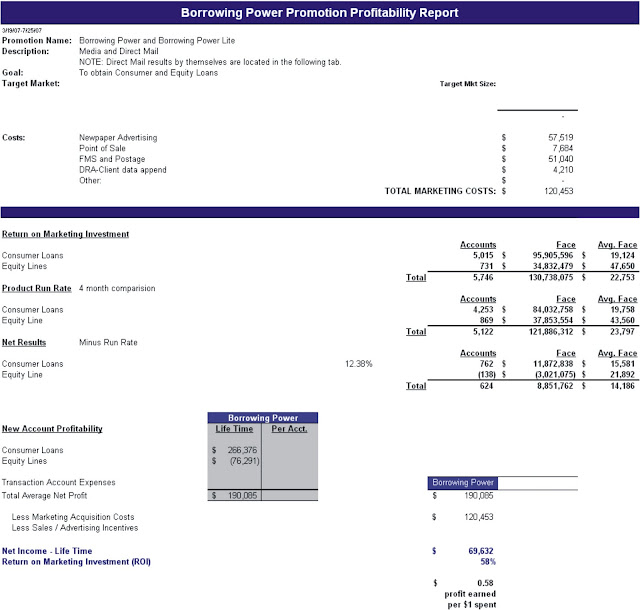

| The above Excel file provides data about the campaign from expenses, income, balances, run rates applied, excluding on boarding and life time product costs. Life-time income and return on investment. |

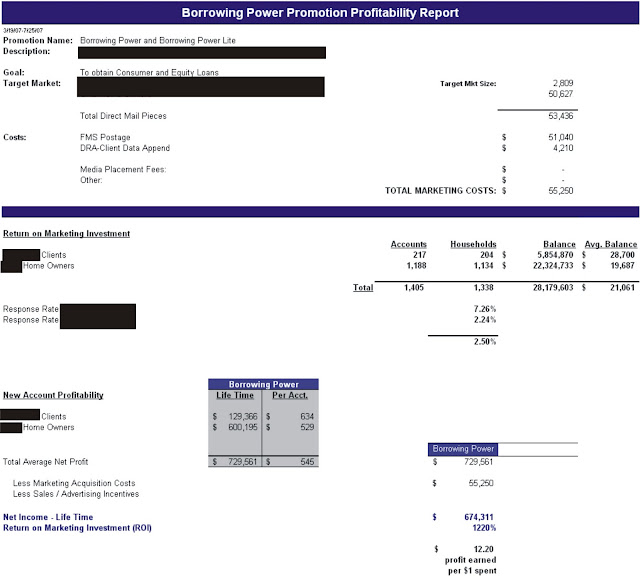

Direct mail results:

If I have a campaign that includes direct mail I provide a second document that looks at the response rate and then the product results from this group. I do not exclude any run rate unless it was only a direct mail program. This final document will provide the “results” of those that responded to the mail piece.

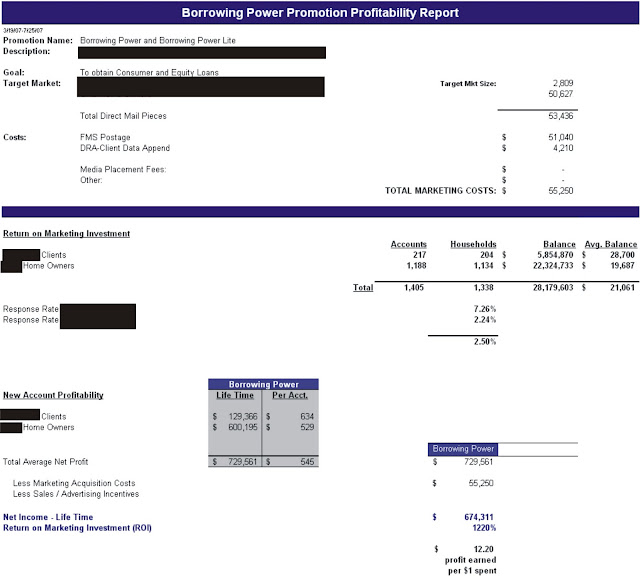

|

| Direct mail results will be mutually exclusive however in the overall results this information has been included. Basically the same information is made available, however no"Run Rates" are included. Response rates are show split out if multiple product types are offered. |

Now the theory here is I look at Direct Mail data mutually exclusive to the overall promotion. Even though no definitive conclusion can be made as to if the results came from the mail piece, we can provide a response rate as to those that had this media touch point. It is just a review to determine if the list was correct for the campaign. The results will already be included in the overall campaign.

You can split this data out because your direct mail costs can be separated.

Conclusion

Once you have completed all of the components you get your chance to formulate your conclusion or opinion about the campaign. This must be non-bias addressing all of the good and bad points of the program.

I always go into each ROI with the assumption the program lost money. This will allow you to look under every rock and look at the program from every angle. I have yet to find a marketing campaign that I’ve not learned something from.

Sit down with the Group

The very last component in my ROI's is the opportunity I get to sit down with those involved in the program. Marketing, Sales, Finance, IT. Discuss the findings. Use this time to allow for discussion if additional input is needed. The process will strengthen your relationship with all parties, as well as, moving your organization forward to become more knowledge.

In the conclusion, keep in mind it is a learning process on how to build an ROI. What can you extract from the data to either exploit the positives or learn from the mistakes. Always make notes as to the economy and weather, they can have a major impact on the results. Just make sure you document those and at times include them in your conclusion.

Remember: Test and Learn

Never look at any program as a failure they are only learning experiences that can be used for the next program.

If you have additional questions or would like to see other topics e-mail me or leave a comment below.